Equity Fund

Equity Mutual funds invest in equity and equity related instruments. An investor who require a high rate of return, have a long investment horizon and able to take short term volatility risk associate with stock market can invest in equity mutual funds. Equity funds can be further classified as Diversified Equity Funds, Sector Specific Funds and Thematic Equity Funds.

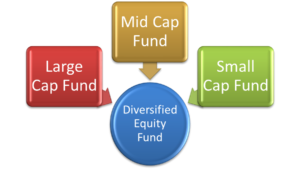

Diversified Equity Fund

Diversified equity funds invest in equity shares across of various sectors, size and industries. The main goal of diversified equity fund is growth. Fund manager choose growth oriented stocks whether they belong to same industry or not. These funds are more volatile than debt or balanced mutual funds. Diversified equity funds can be further divided into large cap, mid cap and small cap funds. Some examples of diversified equity funds are Kotak Standard multicap fund, SBI Magnum multicap Fund, L&T equity Fund.

Large Cap Fund

Large cap funds invest in companies which have a large market capitalization and are industry leaders. These companies have good record of profit and dividend paying. These funds are less volatile. These funds are a safe bid for equity investor and outperform in long run. Some examples of large cap funds are Reliance large Cap Fund, SBI Blue Chip Fund, HDFC Top 100 Fund, Tata largecap Fund.

Mid Cap Fund

These funds invest mainly in midsized companies which have potential to become large cap company in long run. These funds are more volatile than large cap and less volatile than small cap but give more growth than large cap funds in long run. Some examples of Mid cap Funds are Kotak Emerging Equity Fund, HDFC Mid Cap Opportunities fund.

Small Cap Fund

These funds invest mainly in small sized companies which can give good return in long term. As a small cap company has more space to grow in comparison of large caps, therefore these funds generates higher returns than large and mid cap. But these funds are more volatile than large and small cap funds and possess higher risk. Some examples of Small Cap fund are DSP Small Cap Fund, Franklin India Smaller Companies fund, L&T emerging Businesses fund, SBI Small Cap Fund,

Sector Specific Funds

These kind of funds invest in companies belong to same sector or industry. For example FMCG fund have FMCG companies in their portfolio, Banking and financial funds have Banks, NBFC and other financial companies in their portfolio, similarly IT Funds, Pharma Funds, Real Estate Funds, Metal Funds are various examples of sector specific fund. These funds are high volatile because a cyclical movement in industry can affect returns badly, because if industry faces any problem than whole portfolio will affect. Therefore before investing in these kinds of funds one must be very informative and positive about the future outlook of the industry specified.

Thematic Equity Fund

Thematic equity funds invest in companies which are related to a particular theme. As these funds invest in different industries or sectors therefore, these are different from sector specific funds. For example, if the fund’s objective is based on the infrastructure theme than fund will invest in Steel companies, cement companies, construction companies and other companies related to infrastructure development. These are more risky and volatile than diversified equity funds but less than sector specific funds. These funds are good for the investor who is willing to take risk to get higher returns. Some examples of thematic equity funds are SBI Banking and Financial Services Fund, Frankin Build India Fund, SBI Healthcare Opportunities, L&T Infrastructure Fund.