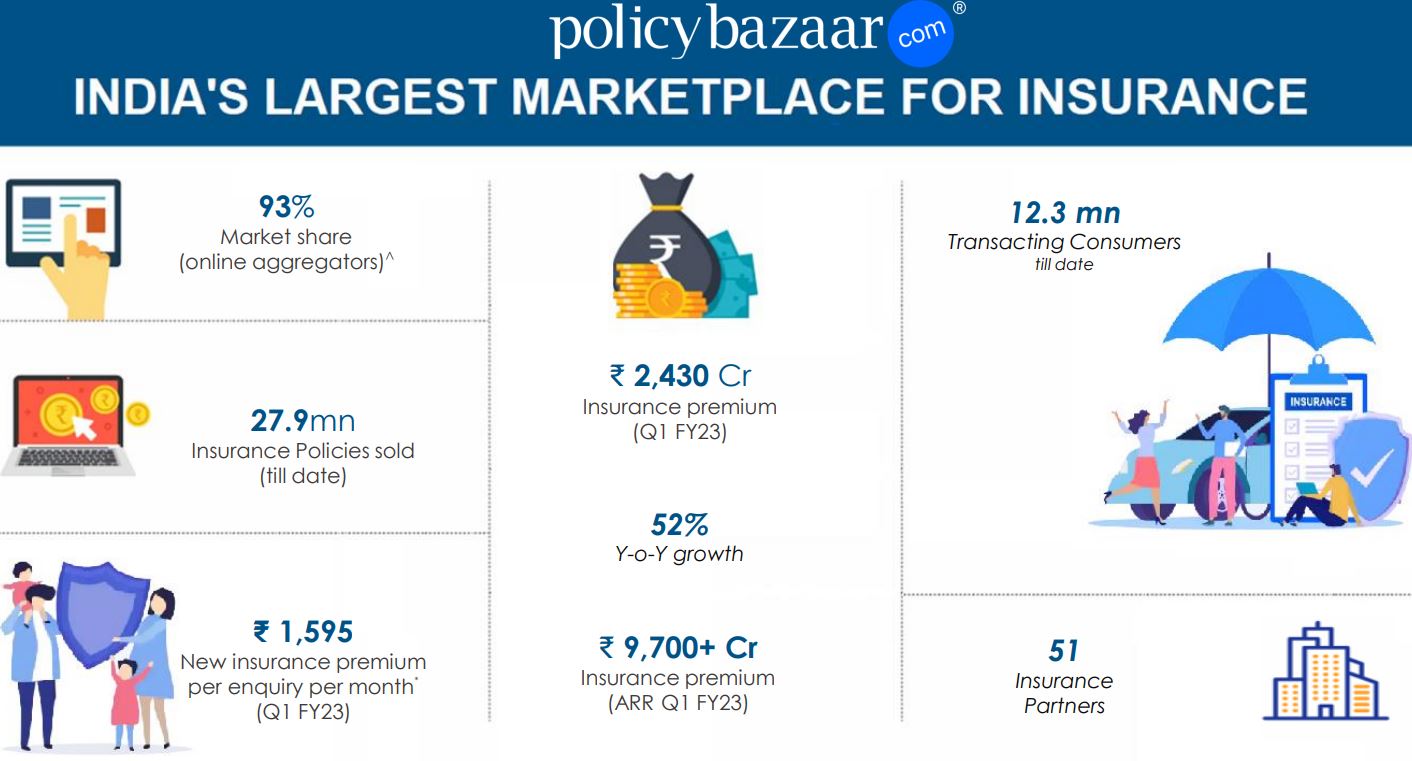

PB Fintech Q1 FY23 Results Key Highlights

- Q1 Consolidated Revenue up 112% YoY and Net Loss Rs. 204 Cr

- Insurance Premium Rs.2430 Cr, up 52% YoY, Credit Disbursal Rs.2320 Cr, up 136%

- Total Insurance Premium Rs.2430 Cr – New Business – Rs.1390cr Renewal – Rs.1040 Cr

- Core Business (PolicyBazaar & Paisa Bazaar) growth in revenue 59%, Core Business Adjusted EBITDA Positive

- New Initiatives: PB Partners (POPS), Corporate & SME Insurance and UAE

- New Initiative Revenue at Rs.134 Cr, about 29 times YoY, Investment in new initiative Rs.71 Cr (was Rs.90 Cr in last quarter)

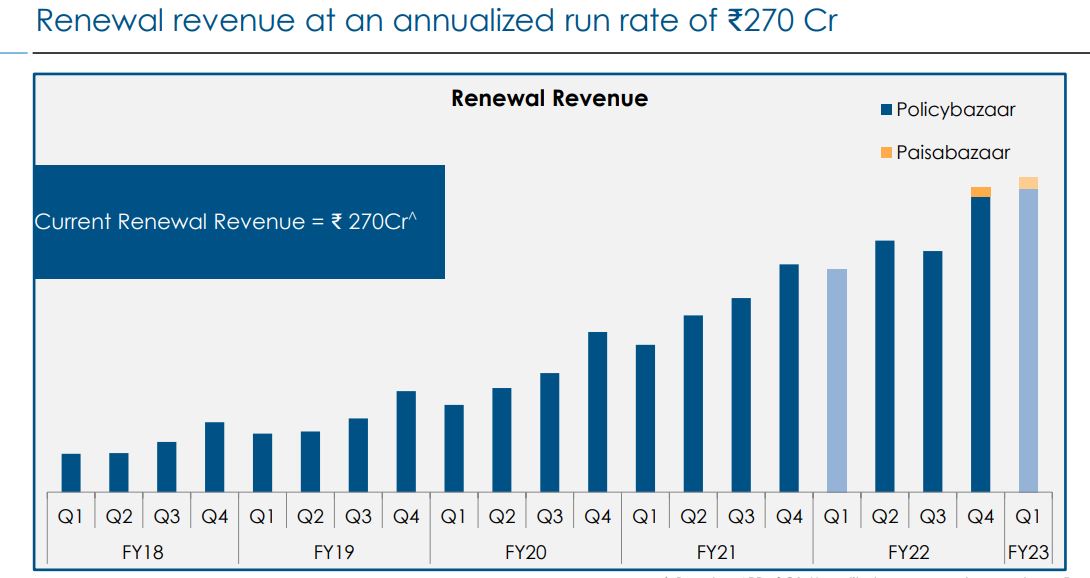

- Renewal Revenue at annualized rate is Rs.270 Cr (was Rs.260 Cr in Q4, Rs.210Cr in Q3 FY22) which has 85% Margins (in Q3 Co was claiming to have margins of above 90%, in Q4 last quarter claimed 87% to 90% and now saying having 85% margins)

- Omni Channel: 40 insurance centers in 32 cities

- Core Business EBITDA should grow Rs.150 Cr every year

- Comfortable with Cash Burn of Rs.200 Cr every year for New Initiative

- Q4 seasonally best quarter and Q1 weakest one

- Could be Whole Group Adjusted EBITDA positive by Q4 FY23

- ESOP Cost for this quarter Rs.167 Cr

- Cash Reserves as on 30th June 2022 Cash on Balance Sheet Rs.5000 Cr

Source: