Astral Q3 Results Key Highlights

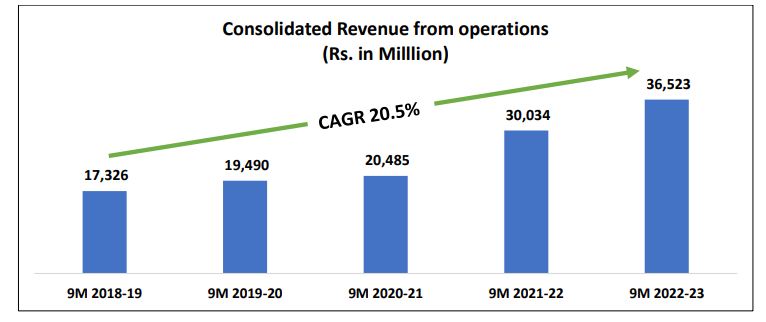

- Q3 Consolidated Revenue up 14.9% and Net Profit down 27%

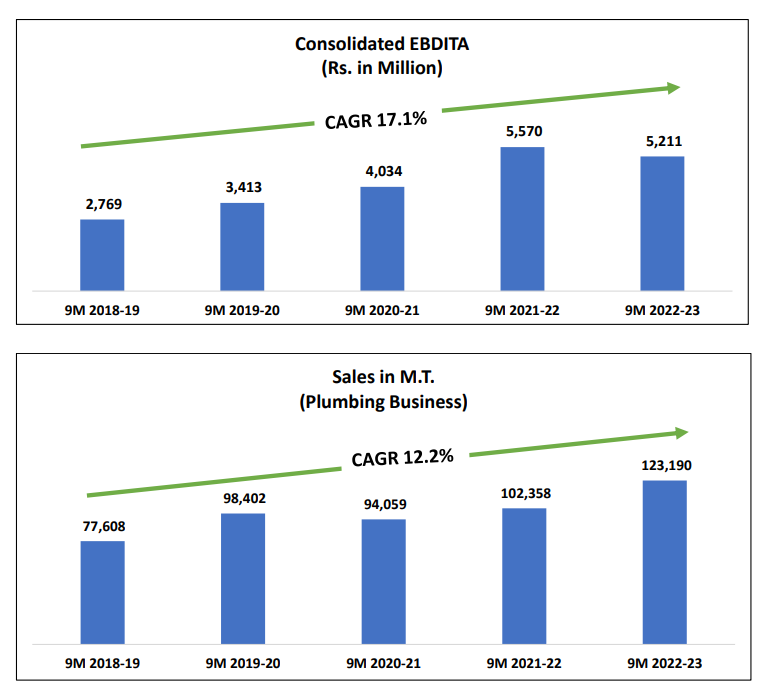

- EBITDA Margins 14.5%

- Margins have improved in Q3 from Q2 and will further improve in Q4

- Incurred Loss of Rs. 13 Cr for its new business of faucet and sanitaryware for 9 months ended 31st Dec 2022. Planned to have 500 Showrooms by year end out of which 231 are already ready

- Cash position as on 31st Dec 2023 is Rs.476 Cr

- Q4 historically a good quarter for company. We may see inventory gain unlike inventory losses in earlier quarters

- In last 3 years company is doing continuous capex and at present capacity utilization is just 57% so company has enough capacity. Here onwards financial ratios will keep improving as most of the capex is done. This will lead to solid FY24 for Astral

Source: