Astral Q2 FY23 Results Key Highlights

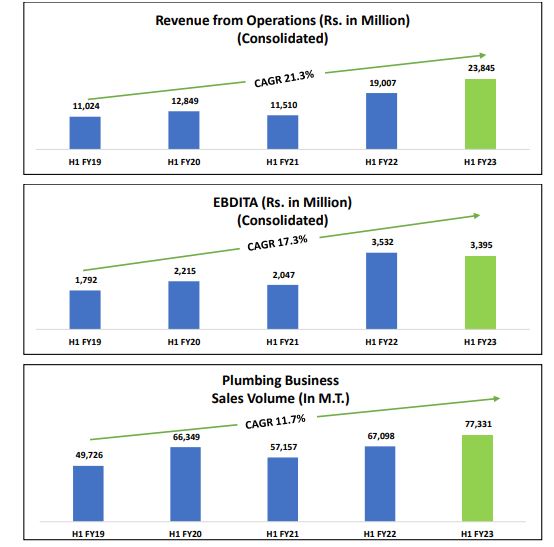

- Q2 Consolidated Revenue -2% and Net Profit down 50% YoY

- EBITDA Margins 12% vs 18% YoY

- Heavy Inventory Loss (Around Rs.70 Cr in H1) due to PVC price fluctuation, which may continue in Q3. Some inventory loss may come in Q3 too

- Business defined here onwards in two division – Plumbing (which will include Pipes, fittings, water tanks, faucets and sanitaryware) and Paints and Adhesives (Gems Paint + Resinova+ Seal IT). Business Performance H1

- Marginal degrowth of 4% in volume due to higher base and destocking by dealers

- In H2, there will be high double-digit growth in volume

- 6 days business lost due to approvals for Resinova merger

- Started manufacturing of CPVC, SWR and Agri Pipes along with Water Tank at Odisha Plant (East)

- Sanitaryware & Faucets – 34 Showrooms are ready and plan for 500 showrooms before year end. Set up cost will be borne by channel partner

- Sales number from Sanitaryware and Faucets will start coming from next year

- Long term sustainable margins are 15%

- Cash as on 30th Sep 2022 is Rs. 459 Cr

- Capex for FY23 is Rs. 250Cr

Source: