Amber Q3 FY23 Results Key Highlights

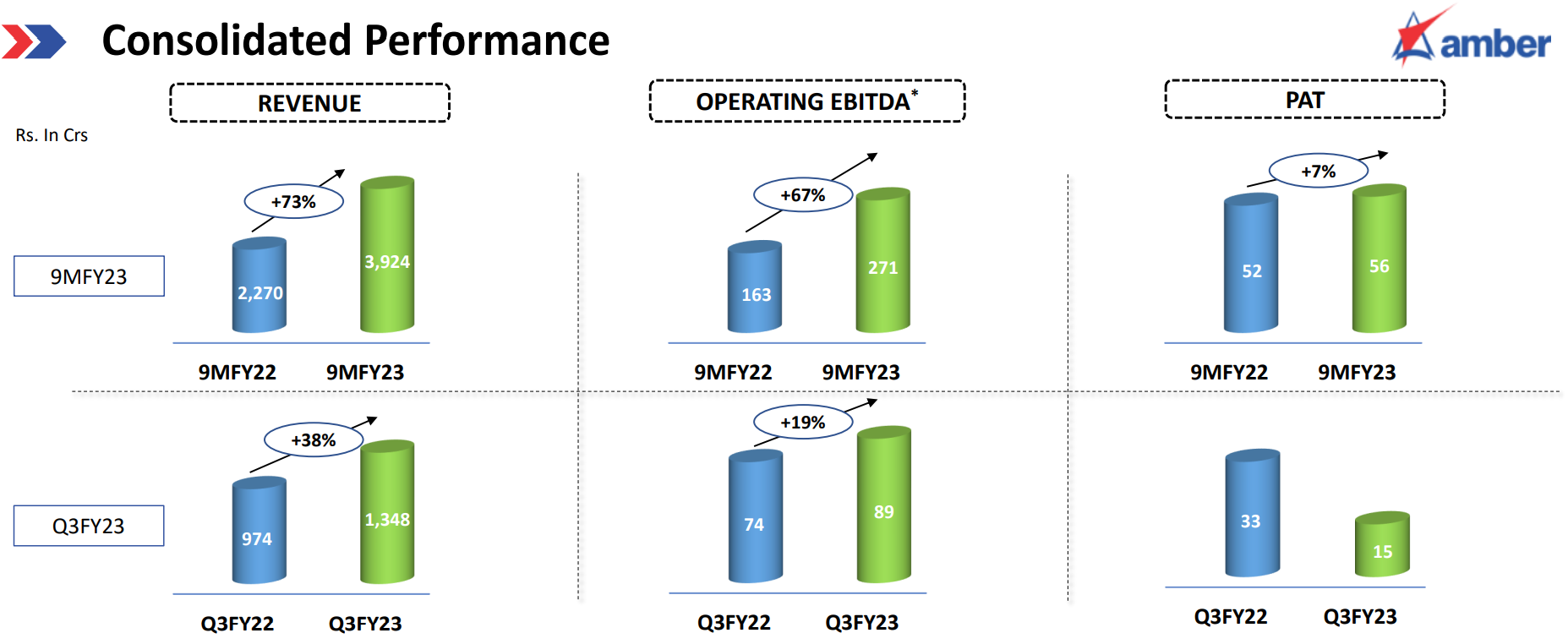

- Q3 Consolidated Revenue up 38.39%, Net Profit down 55.95%

- EBITDA Margins 5.8% Vs 7.6% YoY

- In Q3FY23 Financial Cost and Depreciation increased to Rs.29 Cr and Rs.36 Cr from Rs.12 Cr and Rs.27 Cr in Q3FY22, respectively. Increase is due to increase in capex as well as rising interest rate

- Dynamics are changing in industry as Big brands changing strategy from outsourcing to build inhouse due to PLI scheme benefit. Amber has anticipated this well in advance and shifted focus toward components. RAC component business grew by 109% in Q3 FY23

- For component manufacturing entered in new geographies like Sri City and Chennai

- In electronic division, after hearable and wearable we are in advance stage discussion with new customer in Telecom sector

- Expanded manufacturing of electronic products with new facility in South India

- Electronic Division (ILJIN and Ever) expect to grow 50% in FY24

- Mobility Division has order book of Rs.700 Cr

- Motor Division with strong order book expect more than 30% growth in FY23 and FY24

- Capex will be Rs.625 Cr to Rs.650 Cr in FY23 and next year in FY24 it will be just Rs.250 Cr to Rs.275 Cr only

- Industry was very hopeful for Q3 but ended up a muted quarter with no sale in Oct and Nov and first half of Dec

- Gross Debt Rs.1350 Cr (Rs.600 Cr Term Debt) and Net Debt level is Rs.900 Cr at present where as we expect to close FY23 at Rs.450 Cr to Rs.500 Cr.

- Amber can expect 30% plus absolute EBITA growth in FY24 and FY25 (Company want investors to focus on this absolute growth of EBITDA by 30% instead of EBITDA Margin)

- In Metros, Sidwal has market share of 60% in mobility business

- Currently 40% Business is from RAC assembly and 60% from other division and Components where as at the time of Listing in 2018 it was above 80% from RAC

Source: